Back in 2008, America faced the worst financial crisis it has known since the Great Depression. People lost their homes, and many businesses closed. However, many Americans to this day still do not understand how the crisis happened.

An Explainer

Failures in regulation are largely blamed as the main cause of the 2008 financial disaster. Because there weren’t sufficient regulatory laws present at the time which determined what kind of mortgage products a lender can offer, many lenders and banking institutions thus offered mortgage products that are considered risky.

During this time, interest rates were low and home prices rose – factors that attracted many American homeowners and borrowers to refinanceand purchase a home. The banks hitched with the opportunity, offering mortgage products even to high-risk borrowers in the form of subprime mortgages. These are loans given to borrowers who have low credit scores and have a high possibility of defaulting on the loan. About 90 percent of these subprime mortgages were adjustable-rate mortgages (ARMs), which usually start out with low-interest rates and reset with an industry-dependent rate after a specified period of time. Many believed that as long as home prices keep rising, they wouldn’t lose anything. Or so they thought.

Big businesses and investors took in the hype, creating a global network of financial hopefuls that are dependent on one fragile factor. So when home prices went down, interest rates hiked and when the large number of ARMs reset, many borrowers weren’t able to afford the mortgage payments. As a result, many homes were foreclosed. The problem now is, the banks lose money on those properties which now have lower values. This created a domino effect to the higher tiers of investors, eventually bringing down financial markets on a global level.

Post-Crisis Law

After this crisis, the Obama administration pushed forward laws that will hopefully prevent another 2008 financial scenario from happening again. With the Dodd-Frank Act, reforms in regulation were established so banks and lenders will not repeat the mistakes that started the crisis in the first place.

With the enactment of the Dodd-Frank Act, mortgages are only made available to qualified borrowers or those who meet qualification standards that prove that they are more capable of paying for their home loans and are therefore less likely to default on it. That did not efface subprime, stated-income, or no-doc loans, however. But the regulation changes certainly made it hard for some rogue lenders to take advantage of vulnerable Americans for their own interests.

A Change

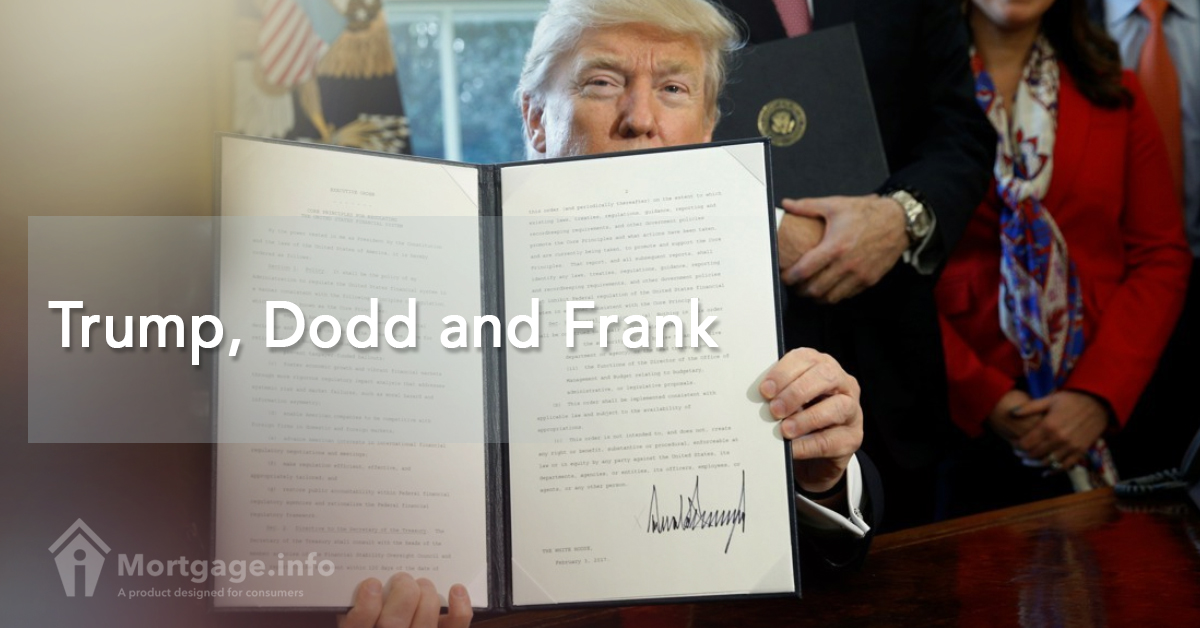

Yet, with an executive order signed by President Trump on Friday, what would prevent another 2008 disaster from happening all over again?

In two directives signed by the president on February 3, the new Republican administration chisels on the Dodd-Frank Act, aiming to loosen restrictions on Wall Street Banks and financial advisers. Specifically, this order directs the following actions to be done:

- An order for the Treasury Secretary to review the Dodd-Frank Act and its regulations on financial institutions. He is then to report to the president and recommend for changes to be made.

- An order for the Labor Secretary to delay the implementation of the fiduciary rule, a regulation set to effect on April 10, which requires financial professionals to put their clients’ best interests first when giving advice on retirement investments.

Resistance

Without the law, many fear that the rollback will recreate the conditions that paved the way to the 2008 housing crisis. Whether this is feasible or not remains to be seen as the orders are set into motion.

Meanwhile, Senate Minority Leader Charles Schumer, D-N.Y. promises that the president’s attempts to repeal reforms on Wall Street are to be met with a “Democratic firewall” in Congress.