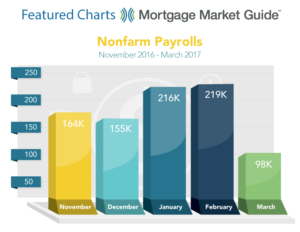

In a news releasepublished by the Bureau of Labor Statistics on April 7, Friday, total nonfarm payroll employment increased by 98,000, a report almost half down of the 180,000 expected by experts. Industries that received a pronounced increase includes the professional, mining, and business services sectors, while the retail sector reported a decline.

Report Highlights

Aside from the weaker jobs addition number that seemed to disappoint a lot of people, the following are some of the highlights that made up the Friday squabble:

- The March report revised the January and February numbers down to a combined total of 38,000 jobs. Initially, February reported an addition of 235,000 and was now revised to 219,000. Meanwhile, the January number was changed to 216,000 from 238,000 previously.

- The unemployment rate fell to 4.5 percent in March, a two-tenths of a percentage point decline from the previous month; a decline not seen since March 2007.

- The private sector worker’s average hourly wage increased by five cents compared to the previous month’s, and 2.7 percent compared to the previous year’s.

- The labor force participation rate held steady at 63 percent.

- A quick run-through of the changes across various industries:

- Professional and business services increased by 56,000

- Mining increased by 11,000

- Healthcare also increased by 14,000

- Financial activities as well marched to 9,000

- Construction increased by 6,000; while

- Retail trade declined by 30,000

A tightening labor market

The sovereign impact of the 2008 housing crisis caused a loss of over 10 million jobs from the period of 2008 to 2010. That’s an average of 420,000 jobs lost per month. After the meltdown – through various legislation and reforms, job creation trended higher at the rate of 200,000 new jobs a month since the late months of 2011.

Seeing the bigger picture, although the current numbers failed to meet the expected, it still reflects a healthy jobs situation in the country, contrary to the constant complaints we hear about job shortage.

Look at the signs – increasing wages, a eecline in unemployment, and continued jobs additions only point to one salient fact – the labor market is tightening. The Labor Department reports that there are currently about five million people in the US looking for jobs, a number parallel to the current figure of job openings.nsity

So what does this mean?

Looking past the numbers, here’s what we can only synthesize from the long-term trend:

- a possible continued increase in salary and wages owing to the higher levels of employment, low unemployment, thus the possibility for companies to pay more in finding and keeping employees

- increased job mobility

- higher real estate prices

- increasing interest rates

- stronger dollars

Is it prime time to lock in?

Despite the recent political noise and the market reports, rates still continue to rise, a trend that prompts market experts to convince borrowers to lock. If you are considering to purchase or refinance, pulling the trigger while the range is still on 4-percent low (average for 30-year FRMs in top-tier scenarios at 4.125 percent) is good advice.