According to the latest white paperreleased by the NAR, home affordability is seen as one of the prime factors causing a decline in homeownership in the Land of the Free. And this is supported by data. According to Zillow analytics, mortgage payments are unaffordable in half of the largest cities in the United States.

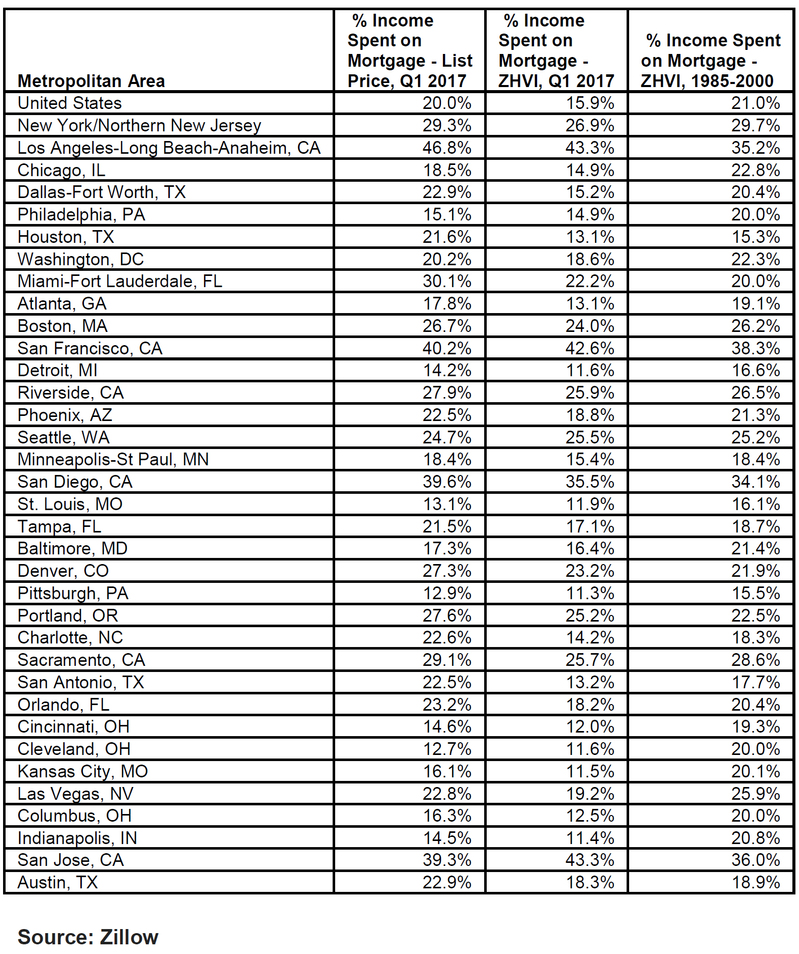

Here are the highlights: a) six of the largest metropolitan areas in California alone have home prices way out of the average Joe’s affordability range; b) the average home price is higher than the average home value of all homes save for three of the largest 35 cities in the US; c) 46.8 percent of the average income is required to afford monthly mortgage payments for homes in Los Angeles; and d) 16 percent of the average income is required to afford the monthly mortgage payments for an average-valued property.

A problem of cost

Basically, homes in almost half of the largest US metros are less affordable than they used to be. Just in the first quarter of the year, the average list price is $246,900 which is way above the historical average of $197,100. In Los Angeles, the average homebuyer should pay $650,000 for an average-priced home – a good 47 percent of the average income in the area.

The concern over housing affordability is even more aggravated by the recent increase in mortgage interest rates. For the past year, mortgage rates had been in historic low levels, offsetting the rise in home prices that is fueled by surging demandand the scarcity in inventory.

On a national average, a buyer would need to spend about 20 percent of the average income in the US to afford the monthly mortgage payment of a typical home.

If wages don’t increase parallel to the pace of home prices, affordability would certainly put a strain to housing. And when cost of living adds insult to injury, what keeps us from envisioning a terrifying scenario for the whole industry sooner than later?