The new President’s first order of the day was to repeal new regulations made during the Obama administration pending review. This rolls back the reduction of FHA’s annual mortgage insurance premiums and its annual potential savings of $500 to households. With the FHA insurance cut suspended indefinitely, what’s in store for the 1 million households expected to use FHA loans to finance or refinance homes?

FHA Insurance Cut: A Timeline of the Reversal

An hour into his official duties, President Trump signed on Jan. 20 an executive order freezing any policies of the past administration that have not gone to effect. This affects policies that were not yet sent to the Federal Register, and if sent, would have to be withdrawn, according to CNN. For regulations that were already published but have not reached their effective date, they would have to be delayed for review, the report noted.

This prompted the HUD, which oversees the FHA, to issue a mortgagee letter confirming the suspension of the reduction of the annual mortgage insurance premium rates. In its letter, the FHA said the insurance cut is suspended indefinitely, noting that it will issue a letter if the policy changes.

“The FHA is committed to ensuring its mortgage insurance programs remains viable and effective in the long term for all parties involved, especially our taxpayers. As such, more analysis and research are deemed necessary to assess future adjustments while also considering potential market conditions in an ever-changing global economy that could impact our efforts,” the mortgagee letter read.

Under the premium insurance cut announced on January 9, homebuyers and refinancers will see their annual MIP rates slashed by at least 25 basis points. The reduction would have gone effect on purchase or refinance mortgages that closed on or after January 27, 2017.

Some industry groups, including NAR lauded the FHA’s efforts to ease mortgage credit to low and mid-income households and first-time homebuyers, with the organization estimating an additional 90,000 to 140,000 home purchases as a result of the cut.

Some Republicans opposed the idea, raising concerns over the financial condition of the FHA’s mutual mortgage insurance fund, which pays out a lender’s claim in the event of a borrower’s default. In support of the cut, the FHA pointed to the Fund’s capital ratio of 2.32% with an economic value of $44 billion as of 2016. Ben Carson earlier said he will examine the insurance cut if approved as successor to Julian Castro as HUD secretary.

FHA Annual MIP As Is

Senate Minority Leader Chuck Schumer was quick to denounce the FHA insurance cut repeal in his statement: “One hour after talking about helping working people and ending the cabal in Washington that hurts people, he signs a regulation that makes it more expensive for new homebuyers to buy mortgages.”

In a USAToday report, the senator said homebuyers could have saved $29 a month on a $200,000 home, in line with FHA’s projected annual savings of $500.

As it currently stands, the annual MIP rate for a 30-year mortgage of less than or equal to $625,500 with a downpayment of 3.5% of the purchase price, will remain at 85 basis points (bps) instead of the reduced rate of 60 bps.

If you refinance an existing FHA loan, you’ll pay an annual MIP rate of 55 bps, which could have been lowered to 25 bps.

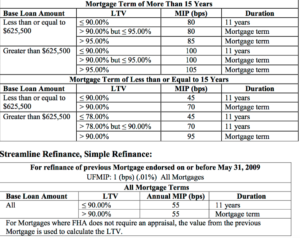

The annual MIP for all FHA mortgages except for (a) streamline refinance and simple refinance mortgages that were endorsed on or before 31 May 2009, and (b) subject to Sect. 247 Hawaiian Home Lands, is as follows.

Screenshot from FHA’s mortgagee letter on the reversal of the FHA insurance cut dated January 20