What will the housing market bring us this 2018? Does the country’s housing industry have a bright future?

RECAP FOR 2017

Before 2017 came, housing industry analysts, expert, and economists have given their predictions on how the real estate market would perform.

In the beginning of the year, mortgage interest rates were expected to take a huge leap. Some analysts predicted that rates would reach past the four percent mark. Many experts also believed that interest rates would rise higher than 4.5 percent. During the first quarter and early second quarter of 2017, this forecast seemed to come true as mortgage rates rose past four percent. As of December 26, 2017, rate hovers just above four percent (30-year term fixed-rate mortgage).

[sc_content_link label=”Check today’s rates, click here.”]

Experts also believed that housing affordability would be a huge issue in 2017. Indeed, home prices remained elevated and continued to scale up. This was believed to be a result of the shortage in residential property inventory.

Housing market professionals had a more positive outlook on the construction of new residential properties for 2017. However, it looked like the industry still failed to meet the huge demand. And although there were around 950,100 new privately owned housing units authorized for construction since the beginning of the year up to September, many states in the country still suffer from low home inventory.

[sc_content_link label=”Know what’s ahead of you in homeownership, click here.”]

You may be Interested in: 2018 Housing Trends Show Positive Outlook For Real Estate Market

Preparing for a Robust Year for America’s Housing Market

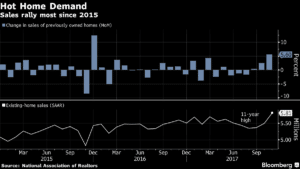

Bloomberg, in its recent report, cited five charts that show the market’s momentum as we enter a new year. One of these charts reveals how sales of previously owned homes faired month over month. According to the report, November sales climbed to its highest level after more than a decade.

This rise in sales of existing homes was fueled mostly by the demand from the upper end of the market. It went past the median estimate set by economists, Bloomberg reported.

[sc_content_link label=”Find the best mortgage rates, click here.”]

One other chart showed the number of existing homes for sale. The housing inventory for November was the second lowest on the record. Bloomberg said that if the real estate market professionals want to attract more homebuyers from all income brackets, the supply needs to increase. “At November’s sale pace, inventory would last just 3.4 months, the shortest time frame in data going back to 1999.” The November inventory hovered just above the all-time low level.

Tax Reform may have Good and Bad Effects on the Real Estate Industry

According to AZCentral, the planned tax overhaul will have both positive and negative effects on the housing industry. Property tax and mortgage interest deductions may reduce once the tax reform takes effect. This will affect filers in pricey markets the most as this will put a cap on the deductions they can take advantage. However, less expensive states may reap the benefits of these changes as experts believe these will encourage more potential homebuyers to reconsider these locations.

Despite these differences, the housing market’s foundations remain strong characterized by steady mortgage interest rates and rising employment rate in most areas in the country.

[sc_content_link label=”Connect with a lender, click here.”]

Today’s momentum may tell us what to expect in the coming year. The current direction the U.S. housing economy is taking shows projections on where the industry is heading unless some dramatic event causes it to shift track. To learn more about the future of mortgage and housing industry, have a talk with your lender. This will help you plan your future ahead in homeownership.

[sc_content_link]