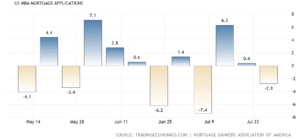

In the survey ending July 28, 2017, the total volume of mortgage applications dwindled after two consecutive weeks of increase in the same month. The refinance activity also scored down slightly according to the latest survey.

Survey Highlights:

- The Market Composite Index has decreased 2.8 percent for a week ago on the seasonally adjusted basis. The index also fell 3 percent on the unadjusted basis in the same period.

- The Refinance Index and the Purchase Indexes dropped over a week as well. The Refinance Index fell 4 percent. On the seasonally adjusted basis, the Purchase Index dropped 2 percent. Similarly, the unadjusted Purchase Index decreased 2 percent from one week earlier.

- Decreasing 0.5 percent from the previous week is the total number of refinance applications. From last week’s 46.0 percent, it is not at 45.5 percent.

- Also dropping from a week ago is the ARM share of the mortgage activity. This week, it accounts for just 6.6 percent of the total applications.

https://tradingeconomics.com/united-states/mortgage-applications

For federal home loan applications, mortgage application activities varied. For applications submitted to the FHA, the volume increased slightly from 10.2 percent to 10.3 percent over a week. For mortgage loan applications with the VA however, the numbers have decreased. From the 10.5 percent in the previous week, it fell to 10.1 percent this week. Remaining unchanged from a week prior is the USDA share of mortgage applications, at 0.8 percent.

>>Click here to get matched with a lender.>>

For conforming loans with balances at $242,000 or less, the average contract interest rate for fixed-rate 30-year mortgages is still at 4.17 percent. It remained unchanged over a period of one week. For fixed-rate loans with the same term having loan balances exceeding 424,000, the average contract interest rate increased to 4.11 percent from the week prior.

MBA’s weekly surveyhelps both borrowers and lenders observe the dynamic changes in the US mortgage market. This data, together with information like rates and home prices, may help homebuyers decide if now is the right time to purchase or refinance their mortgage.