Fewer vacation homes were sold while investment home sales soared last year based on the latest data from the National Association of Realtors’ 2017 Vacation and Investment Home Survey.

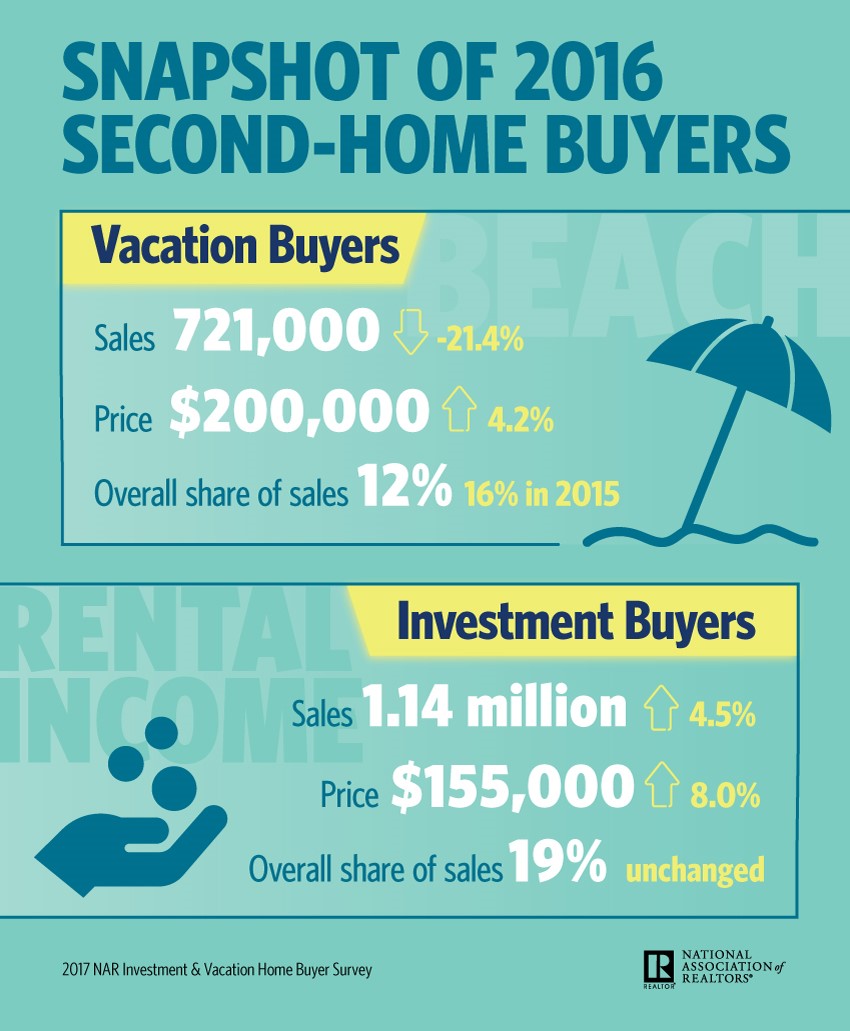

At a glance, there were 721,000 second home sales made and 1.14 million investment homes were sold in 2016.

Pricier, Fewer Vacation Homes

Vacation home buyers closed 721,000 transactions in 2016, a drop of 21.4% from 2015. Last year’s low sales turnout was attributed to pricier, fewer choices on vacation homes, according to NAR.

Lawrence Yun, chief economist at NAR, elaborated in the association’s official magazine article, “In several markets in the South and West – the two most popular destinations for vacation buyers – home prices have soared in recent years because substantial buyer demand from strong job growth continues to outstrip the supply of homes for sale.

“With fewer bargain-priced properties to choose from and a growing number of traditional buyers, finding a home for vacation purposes became more difficult and less affordable last year.”

In 2016, the median sales price of a vacation home rose to 4.2% at $200,000. The vacation home sector took home a 12% share of the overall sales in 2016, down from 16% in 2015. Last year’s market share was the lowest since 2012.

The 2016 sales also meant a 36% drop from its previous peak of 1.13 million units in 2014. Last year marked the second year in a row that the vacation home sales dropped and reached its lowest level since 2013.

A Growing Investment Home Market

On the other hand, investor buyers flocked to the second-home market last year. Investment homes enjoyed an increase of 4.5% in sales, capping 2016 with 1.14 million units sold.

These individual investors were encouraged by the record-low mortgage rates and a growing demand for rentals, contributing to the sector’s highest level of sales since 2012 as per the NAR survey.

NAR’s Mr. Yun related, “The ability to generate rental income or remodel a home to put back on a market with tight inventory is giving investors increased confidence in their ability to see strong returns in their home purchase.”

Investment home prices appreciated in 2016 by 8.0%, selling at $155,000. The share of investment home market remained steady at 19%.

Last year, buyers of investment and vacation homes were more likely to take out a mortgage and use their property for short-term rental, the NAR survey concluded.

The NAR second-home market survey covered new and existing home transactions for the whole year of 2016.