Has the US housing market finally run out of steam after years of continued increases?

After years of continued rise in home sales, experts are worried that the US housing economy may have reached a plateau.

[sc_content_link label=”Need financing?”]

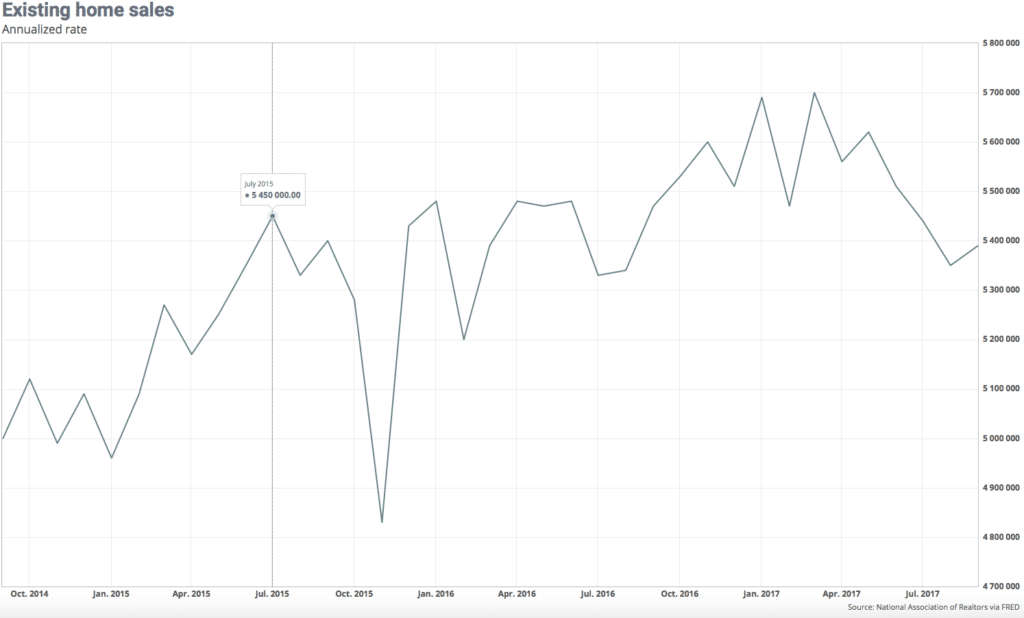

Despite the economy being in good shape, data on previous and existing home sales do not reflect the general economic enthusiasm. In fact, there’s a very real possibility that the current decline in sales number may pose an obstacle in reaching the country’s target annual growth.

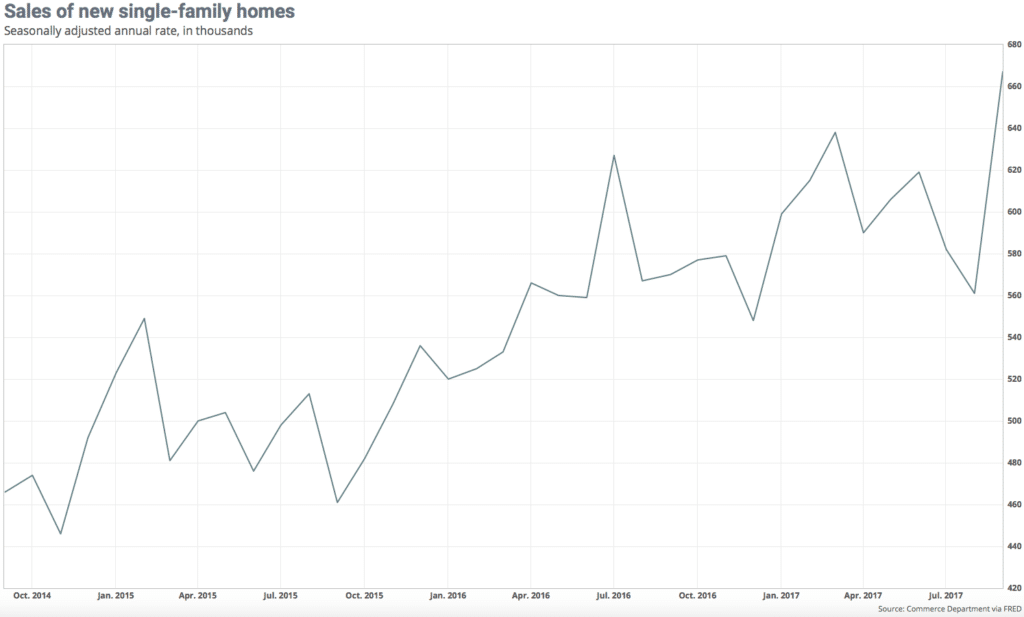

Here’s how the data looks like:

As you can see, the previous three months have seen nothing but a downward movement for previous home sales and more or less the same compared to sales a year ago.

Meanwhile, new homes sales records isn’t any different, seeing a similar state of decline after it climbed to a ten-year peak last March.

When the numbers fail to perform in the manner they are predicted to, the number crunchers wonder. How can it be when the unemployment records is close to a 17-year low while employment opportunities are at their best in a decade?

The drivers

But is it really unexpected? A lot of salient factors can easily be pointed out when looking for driving factors that may have resulted in the current crisis.

For starters, prices have been off-putting for many buyers who can’t afford the price tags of average homes in many major cities in the country. In fact, affordability has been a crucial factor. According to a recent study conducted by HowMuch.net, mortgagees in the country’s major cities (think Los Angeles, New York) have to give over 50 percent of their work time just to afford their monthly mortgage.

And while income is indeed increasing, it is not climbing at the same pace as home prices. Government data show that where income is concerned, home prices are increasing twice as fast, thus putting pressure into the home buyers’ capacity to afford a roof over their heads.

Moreover, some may argue that current mortgage rates can compensate for the skyrocketing home prices. While this may be true, it may not stay true for long, as rates are projected to also increase further sooner than later.

[sc_content_link label=”Find the best lending professional in the business.”]

Builders, contractors, and real estate professionals also have their own concerns regarding the matter. In the past few years, they have voiced their worries over government red tape hampering home constructions. Furthermore, there’s already a shortage of affordable lots to build on.

Yet, even when these factors are mended, the availability of skilled labor and construction materials also pose some roadblocks. Add that to the current state of things when rebuilding overrides any further building efforts after hurricanes devastated the southern region of the country.

Experts say this could place a strain on the country’s growth target, an occurrence that would be first in over a decade.

But would a decline in home prices and an increase in available housing units really get us back on track? It could, but we also have the entertain the possibility that after years of steady rise, the surge in demand has been met and we’re now at the mercy of natural economic gravity.

[sc_content_link]