There remains a gap in home values if you were to ask homeowners and appraisers. This is according to Quicken Loans’ National Home Price Perception Index (HPPI) whose results for May 2017 showed this appraised value vs. estimated value gap widening for the past six months.

On a national level, appraised home values were 1.93% lower than homeowners’ estimated values. Per the maker of Rocket Mortgage, as appraised values move further away from homeowners’ estimated values, they are rising each month.

Proof is the 0.63% increase in home values during the month of May, according to a separate National Home Value Index (HVI) also by Quicken. Home values also rose 4.92% compared to a year ago.

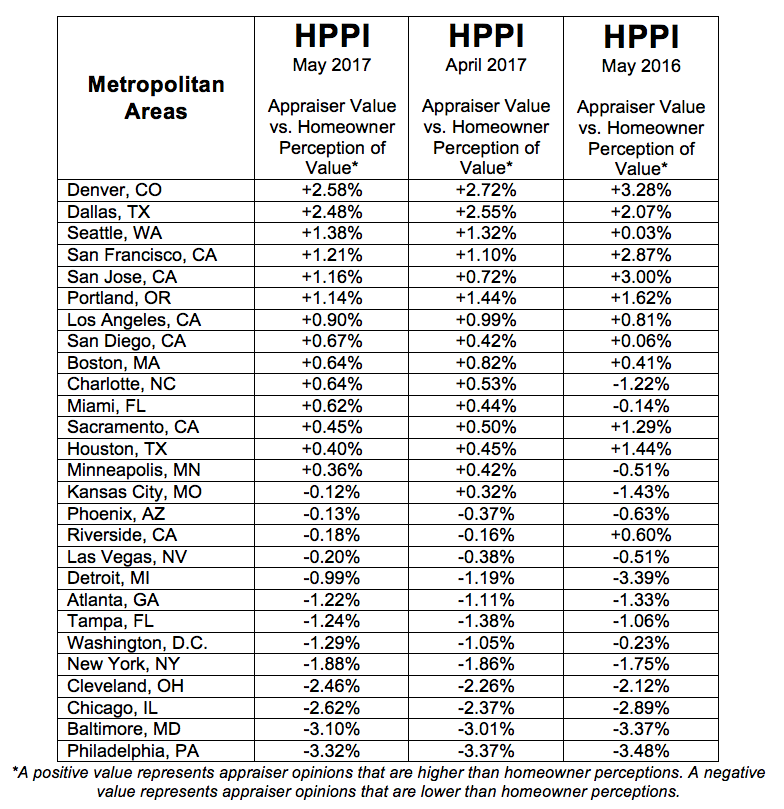

Appraiser Value vs Homeowners Perception of Value

On a nationwide level, homeowners estimated their home values 1.93% higher than appraisers valued their property. There was a slight widening between the two values since April, as measured by a 1.90-percent difference, said Quicken.

May also marks the sixth month where the two valuations — appraiser value and homeowners perception of value – drifted farther apart.

Notwithstanding the national average score, home value perceptions vary among metropolitan areas in the U.S.

Table courtesy of Quicken Loans

The Rise of Home Values

The May HVI indicated a growth of home values on a national level, in most of the U.S. that is, based on appraisals. There was a 0.63% increase in appraised values in May from a month ago and a 4.92% year-over-year increase.

Among the four regions, it was the Northeast that showed a drop in appraised values of 1.63% in May from a month ago. If the annual gains were to be considered, all four regions showed leaps in appraisals between 1.15 and 6.85%.

Home Values Vary

Quicken Executive Vice President of Capital Markets Bill Banfield noted in a statement the relevance in seeing the HPPI and the differing perceptions across the country.

“Home values, and home value changes, vary widely depending on the city you’re in. Homeowners, and those looking to buy a home, should keep a close eye on their local market to better understand home values in their area, and the trend they are on,“ Mr. Banfield said.

Quicken’s HPPI compares homeowners’ and appraisers’ opinions on home values while the HVI examines home value trends based on appraisals alone.